What are Seller’s Discretionary Earnings or SDE?

Seller’s Discretionary Earnings or SDE is a term used to describe the adjusted net income of a business as it pertains to the benefit of an owner. It is usually the best way to determine the value of a business. One way to value a business is to use the SDE of a business and multiply it by a factor, X, which varies from industry to industry. For example, if you have a restaurant that has an SDE of $100,000 a year, the value of that restaurant is going to be 1.5 – 2 times SDE, or $150K to $200K. (1.5 – 2 X is the standard multiple for valuing restaurants)

So how do you calculate the SDE of a business? It is actually pretty straight forward. Standard practice in accounting is to minimize the tax liability of your business. So as a business owner, you want to take advantage of as many deductions as possible. A business has standard deductions, like rent or COGS for example; a business also has non-standard or discretionary deductions as well. Great examples of these discretionary deductions are the owner’s salary, his or her car allowance or lease payment, depreciation, amortization, and interest.

What are Seller’s Discretionary Expenses?

Here is an example of a Seller’s Discretionary Earnings Worksheet; an income statement adjusted to reflect earning potential – called recasting or normalizing your financials.

| Annual Seller’s Discretionary Earnings | |

| Annual Revenue | |

| Annual Cost of Sales | |

| Annual Expenses | |

| Annual Net Income | |

| Adjustments for Interest, Depreciation, Tax and Amortization deductions | |

| Add-back for Interest paid on loans | |

| Add-back for Depreciation | |

| Add back for Taxes paid | |

| Add back for Amortization | |

| EBIDTA (Earnings before Interest, Depreciation, Taxes and Amortization | |

| Adjustments for Personal, Discretionary and One-Time | |

| Expenses | |

| Add-back for Owner’s Salary, Payroll Tax, Benefits | |

| Add-back for Family Member Wages, Payroll Tax, Benefits | |

| Add-back for Owner/Family Personal Auto Use | |

| Add-back for Contributions/Donations | |

| Add-back for Fair-Market Rent Adjustment | |

| Add-back for Owner’s Insurance premiums | |

| Add-back for Legal, Accounting, Tax services | |

| Add-back for Owner Retirement Plan contributions | |

| Annual Revenue | |

| Annual Cost of Sales | |

| Annual Expenses | |

| Annual Net Income | |

| Adjustments for Interest, Depreciation, Tax and | |

| Amortization deductions | |

| Add-back for Interest paid on loans | |

| Add-back for Depreciation | |

| Add back for Taxes paid | |

| Add back for Amortization | |

| EBIDTA (Earnings before Interest, Depreciation, Taxes & Amortization) |

|

| Adjustments for Personal, Discretionary and One-Time Expenses | |

| Add-back for Owner’s Salary, Payroll Tax, Benefits | |

| Add-back for Family Member Wages, Payroll Tax, Benefits | |

| Add-back for Owner/Family Personal Auto Use | |

| Add-back for Contributions/Donations | |

| Add-back for Fair-Market Rent Adjustment | |

| Add-back for Owner’s Insurance premiums | |

| Add-back for Legal, Accounting, Tax services | |

| Add-back for Owner Retirement Plan contributions | |

| Add-back for Travel/Entertainment Expenses | |

| Add-back for Subscriptions and Memberships | |

| Add-back for extraordinary, one-time, non-recurring | |

| expenses reflected on Income statements | |

| Adjusted Statement of Projected Annual Seller’s Discretionary Earnings | |

What is a restaurant worth?

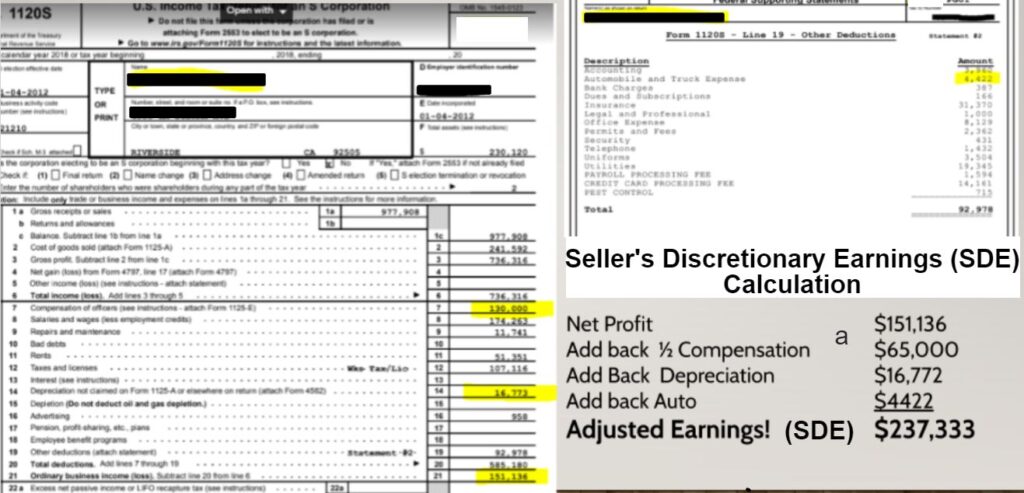

Let’s use the example above to calculate the SDE of a restaurant. Above is a snapshot of a restaurant’s tax return. As you can see, the net income of the restaurant for this year was $151,136. You start with the net, then add back discretionary items to calculate the restaurant’s SDE. The first highlighted item is the Compensation of the Officers for $130,000, this is for a married couple, so we can only deduct ½ of the compensation as discretionary. The next item is depreciation for $16,772, and the last discretionary item is auto expense for $4,422.

As you can see, with the add backs, this business has a final SDE of just over $237,000.

This business had tax returns that are pretty straight forward. Some tax returns are very complicated and can contain other discretionary items like: the owner’s life insurance, charitable gifts, travel, entertainment, and countless others. The key is to make sure you identify all discretionary items to calculate an exact SDE, and therefore prepare an accurate business valuation.

Business Valuations are both an “art and science”

Creating an accurate business valuation is both art and science, so to speak…. As I mentioned before, SDE is only one half of the information you need to make an accurate business valuation (the science part). You also need to use the correct business valuation multiple to arrive at a valuation (the art part).

Thinking about selling a business?

Would you like one of our Business Brokers to help you with a business valuation? Our business brokers have over 5 decades of combined business experience and are proudly accepted as members of the National Association of Business Brokers – NABB.

If you have been thinking about selling your business, contact us for a confidential informational consultation.